在美国也可以买台湾股票。

[stockdio-historical-chart symbol=”ewt” stockExchange=”NYSENasdaq” width=”680″ height=”380″ motif=”financial” palette=”financial-light”]

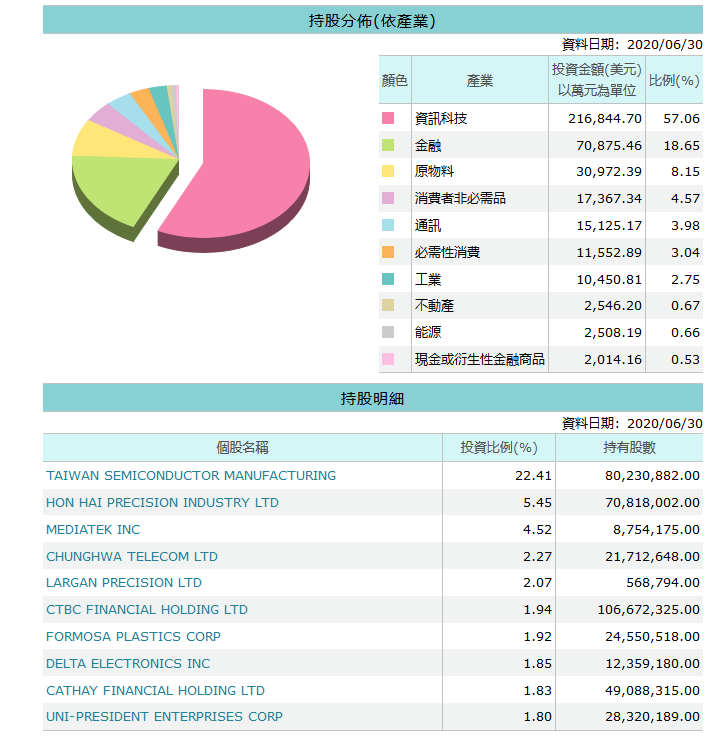

EWT tracks an index of Taiwanese firms, covering the top 85% of the market and weighted by market cap subjected to diversification requirements.

EWT跟踪台湾公司的指数,该指数涵盖了市场的前85%,并受制于多样化要求的市值加权。

EWT is a popular choice for anyone looking for a market-like exposure to Taiwanese equities. “Market-like” in this space means a heavy dose of technology firms. EWT excludes the bottom 15% of companies by market cap but it’s still an excellent proxy for the broad Taiwanese market.

对于任何希望对台湾股票进行类似市场投资的人,EWT都是一个受欢迎的选择。 在这个领域中的“类似市场”意味着大量的技术公司。 EWT排除了市值排在后15%的公司,但它仍然是台湾广阔市场的绝佳代表。

EWT launched back in 2000, and has since built a lofty asset base and robust liquidity, towering over any competition. EWT’s substantial liquidity, reasonable fee, effective management and sound exposure make it the clear Analyst Pick for the segment.EWT changed its name from iShares MSCI Taiwan ETF to iShares MSCI Taiwan Capped ETF on 12/1/2016. It changed its underlying index from MSCI Taiwan Index to MSCI Taiwan 25/50 Index. The new index has explicit diversification requirements which may impact the weights of EWT’s top holdings.

[stock-market-overview stockExchange=”NYSENasdaq” width=”100%” palette=”financial-light”]

[stock-market-news symbol=”ewt” stockExchange=”NYSENasdaq” width=”100%”]